TLDR: see AliExpress' official guide of the new VAT clicking here.

You may have already heard something about this topic. Since July 1, the “Import One Stop Shop” (IOSS) has been implemented, which means paying VAT on all products we import from outside the European Union.

How will this affect our purchases on AliExpress? Are the bargains over?

In today's article we are going to tell you all about the meaning of this.

What happens to VAT from July 1, 2021?

In light of the VAT reform plan that the European Union adopted in 2015, it was agreed that all products imported into the EU as of July 1, 2021 will have to pay VAT in their respective countries.

This will not only affect products coming from China, but also from the other countries outside the European Union.

Why are they now applying this VAT reform?

Until now, the items we bought for less than 22€ were exempt from VAT. Both the sellers and we (the buyers), took advantage of this to try to get rid of paying taxes by declaring the items for a value of almost less than 22€.

As you know, until now, the only way the local tax office had to check if this was true or not, was with the customs clearance. But with thousands of packages arriving daily in European countries, it was impossible to check them all.

Obviously, the states have stepped up to the plate and changed the law to collect everything that had been slipping through the cracks until now.

How will I have to pay VAT from now on?

We have already told you that, as a general rule, you will not have to do anything at customs clearance. Nor will the courier require you to pay any amount if you want them to deliver your package.

Everything will be much simpler than that: the IOSS (Import One Stop Shop) will allow platforms like AliExpress to manage the VAT themselves for items under 150€.

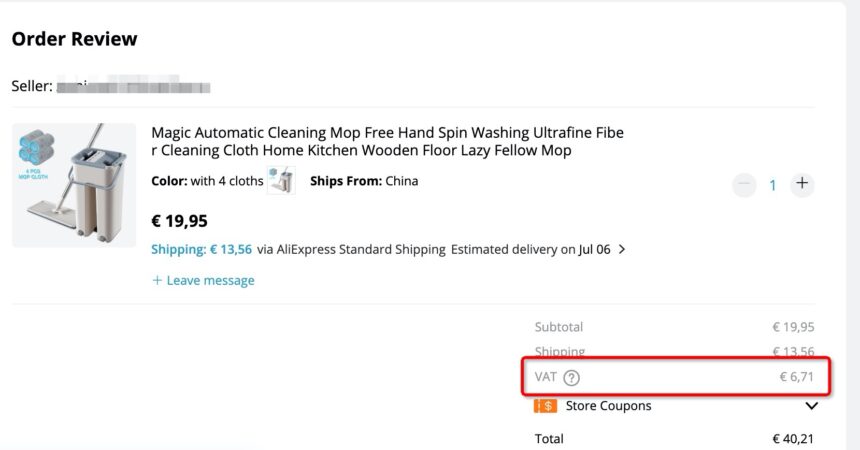

This means that now, when you buy an item, you will pay the VAT directly through AliExpress and they will be in charge of settling it periodically with the local tax office.

Therefore, your shopping experience will not change at all. The main change is that customs will no longer hold orders (unless you are buying illegal products, of course).

AliExpress has been using this method in the UK since the beginning of the year

This increase was planned for the beginning of 2021 and, as a result of the Covid-19 pandemic, it was delayed until July of this year.

In countries such as the United Kingdom, this method began to be used in January 2021 and does not seem to have been a major issue within the citizens.

What about AliExpress items over 150€?

It seems that orders over 150€ are the exception and will continue to work as they currently do.

Anyway, for orders over 150€ it is always better to look for items that are shipped from warehouses within the European Union or from AliExpress Plaza. This way you will avoid any potential issues.

What if I buy from warehouses in the European Union?

For some time now, AliExpress has enabled warehouses in some countries of the European Union such as Spain, France, Belgium, Poland and the Czech Republic (and surely there will be more and more).

VAT is also added to these products at checkout:

Therefore, since we have to pay VAT on both products shipped from Europe and from China, it is always better to choose the European option to receive the order earlier.

If you want to read more about these products shipped directly from EU countries, you can check our article about Cainiao Warehouse Standard Shipping.

Is everything going to be more expensive?

Some AliExpress sellers have told us they are willing to lower their margins to compensate for this increase, but we will have to see how it goes little by little.

AliExpress has become a very important e-commerce company worldwide that generates shocking annual profits. Taking into account that a fundamental part of their profits are thanks to European Union countries so it is clear that they will not risk losing competitive prices and losing customers.

It is also true that many of the items we find have a price two or three times lower than what we can pay in any local store (in addition to the wide range of products that we have just a “click” away).

So, even with the VAT increase, we are sure that it will continue to be more compelling to buy from AliExpress.

Pros and cons of IOSS

In short, all this has its advantages and disadvantages, so we'll list them below.

Cons

- Orders from China will be slightly more expensive, as we will be charged VAT there.

Pros

- Sellers are likely to adjust their prices downward, so we won't notice the increase as much.

- There will be more and more European warehouses and with more variety of products, so we will receive our orders sooner.

- We will no longer have to worry about packages being stopped at customs.

5 Comments

No comments found

what is the Aliexpress IOSS number?

There is also VAT on items shipped from European warehouses because the sellers aren’t European!

Totally right, post updated. Thanks!

For orders from local and European warehouses, we will continue to pay no VAT.

You have to pay VAT even if parcel is shipped from EU warehouse.

You are right, there wasn’t VAT when we wrote this post. We already updated it, thanks!